Update July 5, 2025 - The passage of bill H.R 1 changed the end date of the 30C tax credit from December 31, 2031 to June 30, 2026. Chargers must be fully operational by that date to qualify for the tax credit. All other guidelines and requirements remain the same.

Original Article:

The recently passed Inflation Reduction Act (IRA) has been making headlines over the past few weeks. While the legislation has been covered heavily in the media, most publications have glossed over the reinstatement of the tax credit for EVSE equipment. They instead focused on the tax credits for electric vehicles (EVs), increased funding for IRS enforcement and prescription drug cost caps. But this renewed incentive also presents a huge opportunity for anyone looking to install EV charging equipment. It extends and improves the previous tax credit available to businesses and residences.

Renewing The Previous Tax Credit for EV Chargers

For the past few years, most businesses and homeowners who installed electric car chargers could file for a tax credit to help offset the cost. Congress extended the credit several times, but it was finally allowed to expire on December 31, 2021.

Since the beginning of the year, it has been unclear whether Congress would renew this credit for projects completed in 2022. With the passage of the IRA, the federal tax credit for EV chargers, commonly referred to as the 30C Tax Credit, has been extended until December 31, 2032. The rules have also changed slightly.

Commercial EV Charger Installations

Businesses and other organizations that install EV chargers at their facilities can qualify for an incentive of up to 30% of the cost. With the passage of the IRA, the maximum amount of the tax credit has increased from $30,000 to $100,000 for projects completed after December 31, 2022. Projects completed before then would still be subject to the $30,000 cap.

The extension also has a few changes for installations completed after December 31, 2022. The credit now requires that projects pay the prevailing wage for labor and meet certain apprenticeship requirements to get the full 30%, otherwise the incentive is capped at 6%. The act also allows for bi-directional charging equipment.

Residential EV Charger Installations

Homeowners who install EV chargers on their property also qualify for a tax credit. The tax credit covers both hardware and installation costs. The credit remains the same under the new bill; 30% of the project costs up to $1,000. Some new additions include allowing bi-directional charging equipment.

Both commercial and residential chargers must be in "Approved Census Tracts"

One of the biggest changes of the extension is that commercial and residential installation must be in approved census tracts in order to qualify for the incentive. These tracts are typically low-income or non-urban areas. According to the White House, these tracts cover approximately 2/3 of the Americans. While this new requirement went into effect January 1, 2023, the Department of Treasury did not release definitive guidance on what these approved tracts would be until January 19, 2024.

How to get the Federal Tax Credit for EV Chargers

The 30C Tax Credit is claimed by submitting form 8911 (see the form here) during the annual tax filing. The full guidance from the IRS can be reviewed at this site (IRS Guidance 8911). Unfortunately, these documents have not yet been updated to reflect the new legislation.

Tax Credit Versus Tax Deduction

Many in the electrical distribution industry are familiar with tax incentives such as the 179D Tax Deduction for energy-efficient equipment. However, that was a tax deduction, which meant it was subject to the taxpayer's rate. This incentive is a tax credit. A tax credit is a dollar-for-dollar reduction of a customer's tax liability, so it has a much greater benefit to customers.

That means if a business received a tax credit of $5,000, it would decrease the taxes they owe by $5,000. A tax deduction, however, would be subject to their tax rate. So if they received a tax deduction of $5,000 and fell into the 22% tax bracket, the deduction would have saved them $1,100 rather than $5,000. So the bottom line is that a tax credit is usually much more valuable than a tax deduction.

Just the Tip of the Iceberg

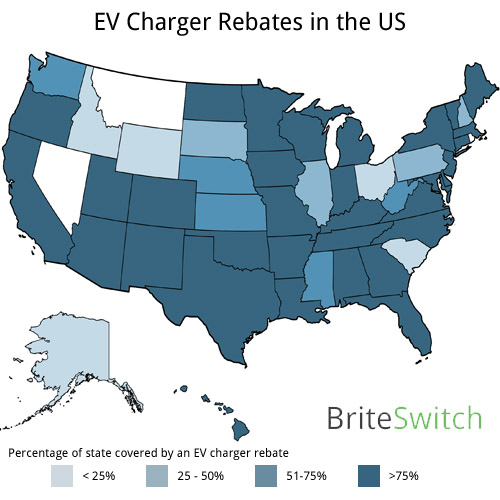

It's important to remember that the federal tax credit is just one of the incentives available for customers installing EVSE equipment. On top of that credit, customers may be eligible for rebates from their state, utility, county, regional organization or municipality. In fact, 63% of the country currently qualifies for a rebate for installing EV charging equipment.

Find All The Possible EV Charger Rebates

RebatePro for EV Chargers

RebatePro for EV Chargers is a custom-built tool to help find and track rebates for EV chargers in both commercial and residential applications. It was designed from the ground up to reflect the unique way EV charging rebates work. It tracks all five sources of EV charger rebates and makes it easy to narrow down which would apply to an specific installation.